Exploring obscure options for purchasing a vehicle without a credit check can be a daunting task. However, for those who are facing financial challenges, it can be a lifeline. With scammers lurking in the market, it is crucial for individuals to find a reliable and trustworthy dealership. This blog post will guide you through the process of finding the right no credit check car lot, helping you to make an informed decision. Whether you have bad credit or no credit history, there are reputable dealerships out there who genuinely want to help you get behind the wheel of a vehicle.

Key Takeaways:

- No Credit Check Car Lots: Finding a dealership that doesn’t require a credit check can be beneficial for those with a poor credit history or no credit.

- Simplified Approval Process: These car lots typically have a simplified approval process, making it easier for individuals to get approved for a car loan.

- Higher Interest Rates: While no credit check car lots may provide more flexible financing options, they often come with higher interest rates due to the increased risk associated with no credit checks.

- Vehicle Selection: It’s important to research the inventory of no credit check car lots to ensure they have the type of vehicle you are looking for.

- Shop Around: Don’t settle for the first no credit check car lot you come across; make sure to shop around, compare prices, interest rates, and read reviews to find the right dealership for you.

Finding the Right Dealership

Assuming you are in the market for a car but have a less-than-perfect credit score, finding the right dealership that offers no credit check options can be a game-changer. These dealerships understand your financial situation and are willing to work with you to secure a suitable car loan. To locate the perfect dealership for your needs, it is essential to follow a few essential steps.

Researching No Credit Check Car Lots

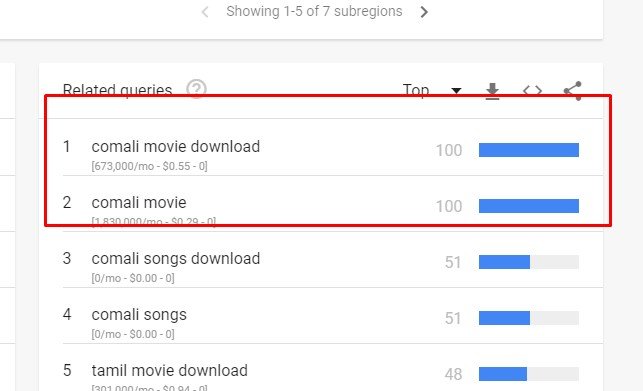

When searching for no credit check car lots, it is crucial to conduct thorough research. Start by browsing through reliable websites, such as No Credit Check Auto Dealers Near Me, which provides a list of dealerships that offer no credit check options in your area. By utilizing such resources, you can save significant time and effort in finding dealerships that specialize in assisting customers with poor credit.

Reviews and Recommendations

Reviews and recommendations from previous customers can offer valuable insights into the reputation and quality of service provided by different no credit check car lots. Take the time to read through reviews on various platforms, such as Google, Yelp, or the dealership’s website itself. Additionally, seek recommendations from friends, family, or colleagues who have had experience with these dealerships. By considering their feedback, you can gain a better understanding of which dealerships have a track record of providing excellent customer service and reliable vehicles.

Comparing Dealership Offers and Services

After narrowing down your options, it is vital to compare the offers and services provided by different no credit check car lots. Here is a breakdown of the key points to consider:

| Offers and Services | Importance |

| Wide selection of cars | Important: A dealership with a diverse inventory increases the chances of finding a suitable car that meets your preferences and needs. |

| Flexible financing options | Crucial: Look for dealerships that offer customizable payment plans and reasonable interest rates to ensure affordability and manageability. |

| Transparent pricing | Essential: Seek dealerships that provide clear information about the total cost of the vehicle, including any additional fees, to avoid surprises or hidden charges. |

| Quality assurance | Important: Ensure the dealership offers inspections, warranties, or guarantees to provide peace of mind regarding the vehicle’s condition and reliability. |

By considering these factors and comparing the offerings from different dealerships, you can narrow down your choices and make an informed decision that suits your needs and financial situation.

Making Informed Choices

To make an informed choice when dealing with no credit check car lots, it is crucial for prospective buyers to gather the necessary knowledge and understanding. This chapter will explore three key aspects that buyers need to consider: understanding no credit check financing, assessing the quality of vehicles, and negotiating terms and conditions.

Understanding No Credit Check Financing

No credit check financing is a payment option that enables individuals with limited or poor credit histories to purchase a vehicle without undergoing a credit check. This option allows potential buyers to obtain a car loan based on other factors, such as income and employment history. However, it is important to note that no credit check financing often comes with higher interest rates and stricter repayment terms. Buyers need to carefully evaluate these terms and the financial impact they may have in the long run. It is advisable to consider the total cost of the vehicle, including interest, to determine if it is a viable option.

Assessing the Quality of Vehicles

When considering a no credit check car lot, assessing the quality of the vehicles available is paramount. Buyers should thoroughly inspect the cars they are interested in, paying close attention to any signs of damage or mechanical issues. It is also advisable to request a vehicle history report to ensure there are no hidden problems. Additionally, buyers can seek the assistance of a trusted mechanic to perform a detailed inspection. A reliable car lot will be transparent about the condition of the vehicles they offer and provide access to any available warranties. By carefully assessing the quality of vehicles, buyers can avoid purchasing unreliable or potentially dangerous cars.

Negotiating Terms and Conditions

Entering into any agreement, including those with no credit check car lots, requires careful negotiation of terms and conditions. Buyers should be prepared to negotiate the price of the vehicle as well as any additional fees or charges. It is essential to clearly understand all terms and conditions to avoid any surprises or hidden costs. This includes reviewing the length of the loan, interest rates, and the consequences of missing payments. Furthermore, buyers should take the time to read and understand the entire contract before signing to ensure they are comfortable with the agreement. By negotiating the terms and conditions, buyers can ensure a fair and favorable outcome.

Financing Options for Bad Credit Buyers

Last year, John had some financial hardships that resulted in a lower credit score. Now, he needs to buy a car but is worried about securing financing due to his bad credit. Fortunately, there are options available for buyers like John who are seeking a car loan without a credit check. By exploring alternative financing sources and actively working towards improving his credit, John can find the right financing option that suits his needs.

Exploring Alternative Financing Sources

For individuals with bad credit, traditional lenders may not be the best option. However, there are alternative financing sources that can help them obtain a car loan. One option is to look for buy here pay here dealerships that specialize in financing customers with low credit scores. These dealerships often provide in-house financing, allowing buyers to make payments directly to the dealership instead of relying on a bank. Another option is to seek out online lenders that cater to bad credit buyers. These lenders may have more flexible credit requirements and offer competitive interest rates. By considering these alternative financing sources, John can increase his chances of finding a suitable car loan despite his bad credit.

Building Credit for Future Car Purchases

It’s important for buyers with bad credit to actively work towards improving their credit scores. By taking steps to build their credit, individuals can increase their chances of securing better financing options for future car purchases. One way to do this is by applying for a secured credit card. With a secured credit card, John can make small purchases and ensure timely payments, effectively demonstrating responsible credit usage. Additionally, he can become an authorized user on a family member or friend’s credit card, benefiting from their positive credit history. By responsibly managing credit and making on-time payments, John can gradually rebuild his credit and open doors to better financing opportunities in the future.

No Credit Check Car Lots – How to Find the Right Dealership for You

Ultimately, finding the right dealership that offers no credit check car lots can be a daunting task. However, with the right research and due diligence, individuals can ensure that they are making a well-informed decision. It is crucial to consider factors such as reputation, customer reviews, and the quality of the vehicles offered. By doing so, one can increase their chances of finding a reliable and trustworthy dealership that will work with them to meet their specific needs. Whether it’s someone with bad credit or no credit history at all, they deserve the opportunity to own a car, and finding the right dealership can turn that dream into a reality.

FAQ

Q: What are no credit check car lots?

A: No credit check car lots are dealerships that offer financing options to individuals with bad or no credit history. They do not require a credit check to approve a loan, making it easier for people with poor credit to purchase a car.

Q: How can I find the right no credit check car lot?

A: To find the right no credit check car lot, you can start by researching online. Look for reputable dealerships in your area that specialize in financing for individuals with bad credit. Read customer reviews and ratings to gauge their reliability. It’s also helpful to ask for recommendations from friends, family, or colleagues who may have had similar experiences.

Q: What should I consider before choosing a no credit check car lot?

A: Before selecting a no credit check car lot, consider the interest rates and repayment terms they offer. It’s important to choose a dealership that provides fair and reasonable financing options. Additionally, check the dealership’s reputation, customer service, and the quality of their vehicle inventory. Transparency in pricing and any additional fees should also be considered.

Q: Are there any disadvantages to using a no credit check car lot?

A: While no credit check car lots provide a beneficial option for individuals with bad credit, there are a few potential disadvantages to consider. The interest rates on loans from these dealerships might be higher compared to traditional lenders. Additionally, the selection of vehicles may be limited, and you may not have access to newer models. It’s also important to watch out for predatory practices, so make sure to thoroughly understand the terms and conditions of the loan agreement.

Q: How can I improve my credit score if I purchase a car from a no credit check car lot?

A: Purchasing a car from a no credit check car lot can actually be an opportunity to improve your credit score. Making timely payments on your car loan can boost your credit history and demonstrate responsible financial behavior. It’s essential to establish a budget and ensure you can comfortably afford the monthly payments. By consistently paying off your car loan, you can gradually improve your credit score over time.